Nollywood gets a new streamer + Paramount Africa’s impending shutdown

Inkblot and Filmhouse partner on a Nollywood-focused video streaming platform and Paramount Africa’s possible move to wind down operations.

Presented by Africa Creative Alliance

Hello there!

In today’s digest, we discuss

Nollywood's latest indigenous streamer

Paramount Global’s potential shutdown of its Africa operations

Centre Spread 🗞️

Inkblot and Filmhouse launch a new streaming platform.

Nollywood powerhouses Inkblot Studios and Filmhouse Group have announced the launch of Kava, a global streaming platform exclusively dedicated to Nollywood and African stories. The platform is scheduled to go live in late August 2025 with over 30 premium titles, including Alakada Bad and Boujee, Owambe Thieves, What About Us, and House Job. New films will be added weekly, and the platform has plans for original content.

Kava enters the market at a pivotal moment. With global streamers like Amazon Prime and Netflix scaling back original commissions and operations in Nigeria, local producers are filling the void. In December 2024, Circuits TV, a streaming platform that described itself as “Africa’s first virtual cinema,” launched. Earlier this month, media mogul Mo Abudu launched EbonyLife On Plus, her second attempt at a streaming platform. Kava is also Filmhouse's second attempt at a streaming platform.

However, as local streaming platforms proliferate and the demand for African content continues to grow, especially among diaspora audiences, the real challenge lies in figuring out the economics of streaming in Nigeria. How do you build a sustainable platform that can actually fund quality filmmaking, effectively distribute those films globally, and still somehow manage to turn a profit, or at least not sustain any losses?

This new crop of indigenous streamers are targeted at Nigerians in the diaspora, but even that might not be enough. According to tech industry analyst Olumuyiwa Olowogboyega, the winners in this new streaming race will “run a multi‑exit flywheel: cinema weekend → SVOD window → airline deals → YouTube → brand integrations. The pure-play SVOD dream is probably dead.”

Still, Kava’s backers are optimistic. “Kava is more than a streaming service. It’s a bold new chapter for Nollywood, designed to meet the growing demand for premium, authentic African content and to redefine how the world experiences our stories,” Kava co-CEO and Filmhouse Group chief said to Deadline. But only time will tell if Kava will survive the market where other streamers have gone to die.

Paramount Global may shut down operations in Africa

Paramount Global’s offices in Nigeria and South Africa and its portfolio of 10 television channels may be shuttered soon.

According to an internal memo seen by The Hollywood Reporter, the company’s regional executives informed staff that an ongoing business restructuring is prompting a reevaluation of its international pay-TV strategy and local cable TV portfolio.

The U.S.-based media company employs around 100 people across its offices in Johannesburg (South Africa) and Lagos (Nigeria). Its operations on the continent span content production and distribution, including popular series such as the East African drama MTV Shuga, reality shows like Unstoppable Thabooty, and the local adaptation of the global franchise Love & Hip Hop: South Africa. It also hosts major live events such as MTV Base Day. Its cable TV channels, featured prominently on the continent’s largest pay-TV service, DStv, have reached over 100 million viewers across 52 African countries. The portfolio includes BET, Comedy Central, MTV, MTV Base, Nickelodeon, Nick Jr., NickToons, and VH1 Classic.

The media giant cut 18.5% of its U.S. workforce last year. In June, when the latest layoff occurred, the company’s top executives suggested that further cuts could extend to international offices as the company focuses on business areas and regions with stronger prospects for revenue growth.

This potential retreat by Paramount contrasts sharply with the recent expansion moves by other global media companies, which are doubling down on Africa as a critical growth market and creative hub for content with international appeal.

There might be a bright side. Paramount is on the verge of a change in ownership, pending US regulators' approval of an $8 billion acquisition deal. If approved, the deal could significantly reshape Paramount Global’s international strategy, depending on the direction taken by the new owners. But for now, the reality is that its 20-year stay on the continent might soon end.

Crunch Time 📈

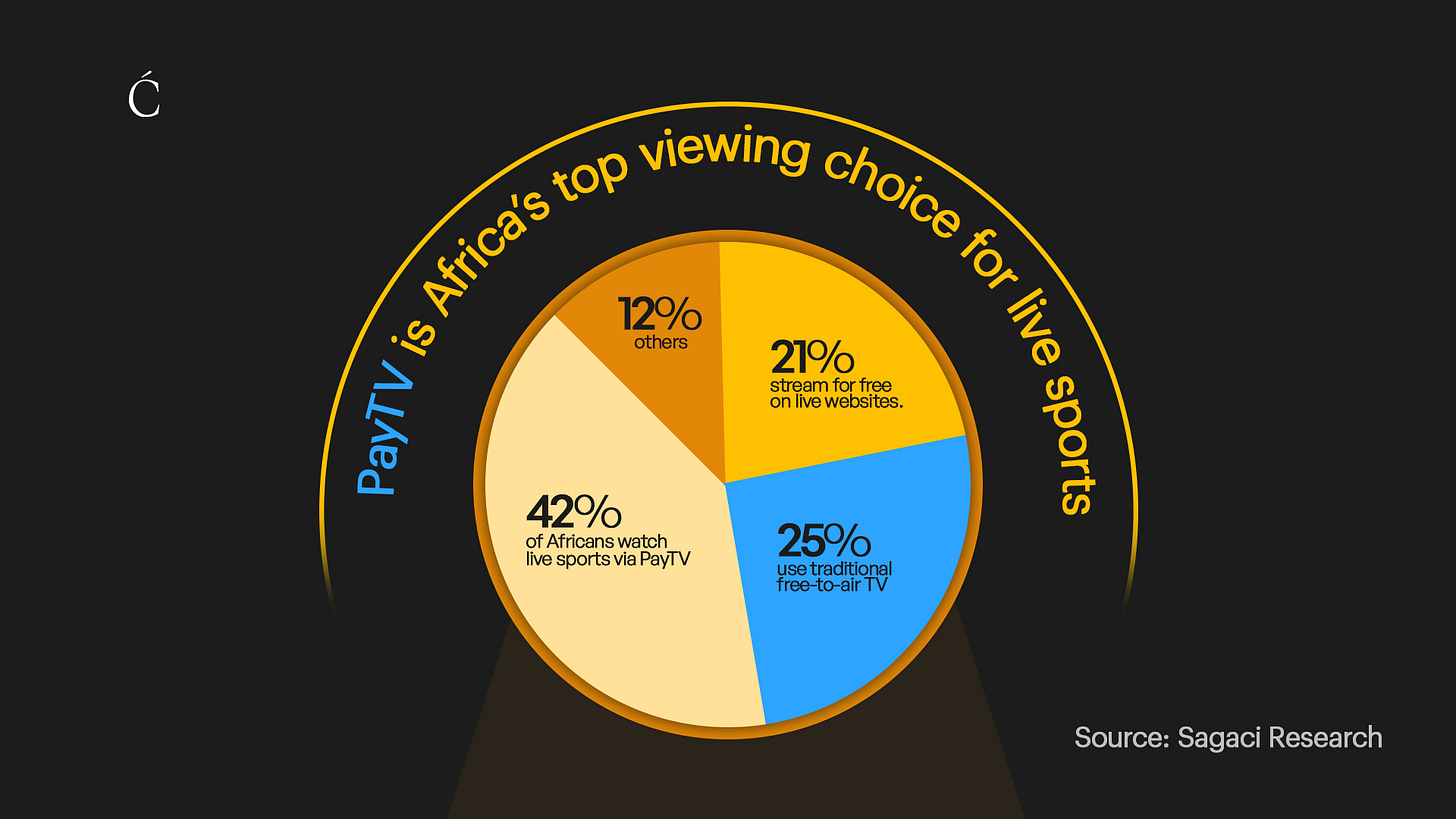

PayTV is Africa’s top viewing choice for live sports

Catch Up 📬

Fusion Intelligence wants to revive community cinemas in Nigeria

Nigerian filmmakers face serious challenges reaching audiences and earning from their work. Cinema-going isn’t mainstream, the DVD market is dead, and while piracy undermines potential revenue, streaming is an option, with fewer incentives to go to the cinema, audiences often turn to pirated copies, leaving filmmakers with limited returns.

The latest Communiqué essay explores how Fusion Intelligence is trying to establish community cinemas as another alternative for filmmakers seeking new ways to distribute their work, making moviegoing more affordable for everyday Nigerians.

Read the essay here.

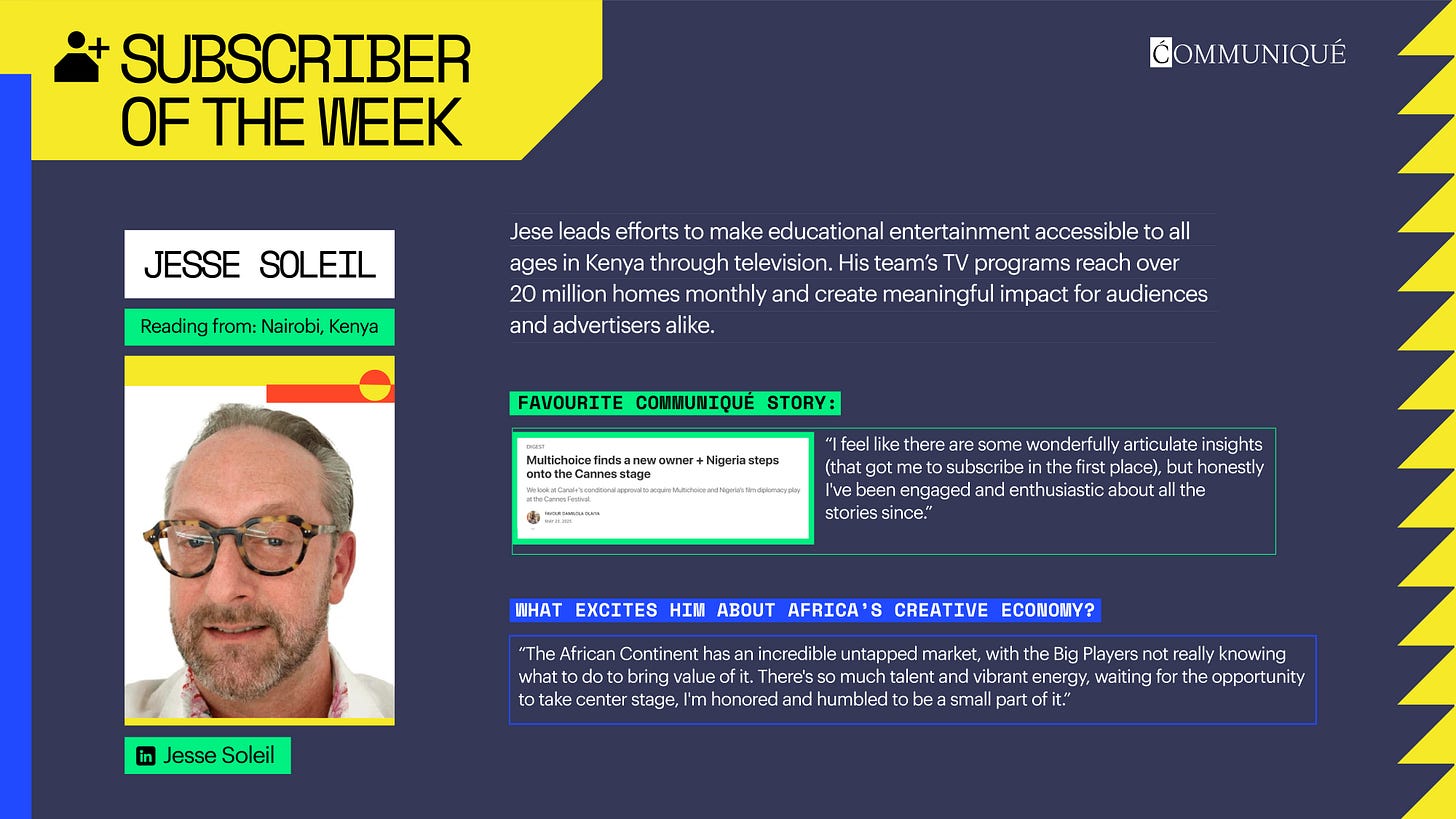

Communiqué’s Subscriber of the Week 🤩

Curiosity Cabinet 🗄️

After granting conditional approval for the Canal+ acquisition of Multichoice in May, South Africa’s competition tribunal gave final approval on Wednesday, subject to agreed-upon conditions. (Pair with our breakdown of what this acquisition means for the DStv operator here and here).

Iyadunni Gbadebo, Eko Hotel and Suites Director of Sales and Marketing, claims that the focus on Lagos alone hampered Nigeria's creative economy.

Spotify continues its push into African artist development with its latest RADAR Africa picks: FOLA from Nigeria and Thakzin from South Africa (Read more about our analysis of the company’s playbook in Communiqué 56)

How Theo Rutstein sold South Africans TVs before the country even had a television broadcast service, and went on to build a media empire.

In 2024, South Africa’s mobile operators generated nearly $9 billion (R160 billion) in revenue from subscribers’ social media usage.

Explore the 1000+ companies, events, investors, and government stakeholders shaping Africa’s creative economy via Communiqué’s African Creative Economy Database.

That’s it for this week’s Digest. See you next week.

This was not on my bingo card. I remember reading that a major Nollywood producer was starting their own streamer and never thought it was Inkblot. Really excited for them, I wish them the best. Wouldn't it be better if they worked together and pooled their resources. I think collaboration beats competition in this case.