Communiqué 80: Fusion Intelligence’s bet on urban community cinemas

With ticket prices up 300% in a decade and box office revenue down to $7 million, Fusion Intelligence is betting on community cinema to turn things around.

Key Points

1. Target affordability gaps in established markets: When traditional pricing models exclude large segments of the population. Creative entrepreneurs can create accessible alternatives that serve underserved audiences, rather than focusing solely on premium segments.

2. Build Full-Stack Creative Ecosystems: Rather than single-point solutions, Fusion built an integrated stack—content delivery, ticketing, reporting, and venue operations. Creative startups should adopt this approach to unlock multiple revenue streams and increase user retention.

3. Leverage Policy Shifts and Local Partnerships: Fusion benefited from licensing waivers and partnered with co-working spaces and distributors. Creative entrepreneurs should monitor policy changes and collaborate with existing networks to scale quickly and reduce setup costs.

1. The community cinema detour

In August, Red Circle, the film debut of maverick director Nora Awolowo, will begin screening at four Café One co-working locations across the country, including Owerri, Kaduna, Uyo, and Enugu.

Red Circle debuted in June to rave reviews and a ₦25 million opening weekend gross. By the third week, it had crossed the ₦100 million mark. Previously, for most Nigerian films, an impressive cinema run like that would typically be followed by a streaming deal months later. But before that, Red Circle is taking a detour: a community cinema run powered by Fusion Intelligence, a Lagos-based technology solutions provider for the hospitality industry.

Fusion Intelligence launched FilmHub, its flagship community cinema initiative, earlier this month with a screening of Omoni Oboli’s Wives On Strike 3. FilmHub offers the features of a traditional community cinema, including low-cost projection technology, locally adapted programming, and grassroots partnerships, to provide a more inclusive alternative to the normal cinema multiplex model.

But rather than targeting only rural or hard-to-reach communities, which has long been the default purpose and strategy for community cinema, Fusion Intelligence is betting that the model can also thrive in Nigeria’s bustling urban centres, where large populations exist outside the reach or affordability of conventional cinema.

2. From Filmhouse to Fusion Intelligence

The primary reason for Nigeria’s underwhelming box office performance in the international market is affordability. In 2019, total box office revenue reached a record 6.9 billion naira, equivalent to $17.7 million at the time. Five years later, that figure had nearly doubled in naira terms, reaching 11.4 billion naira in 2024; however, due to steep currency devaluation, that amounted to just $7 million. For context, the Superman movie released earlier this month grossed $125 million in its opening weekend.

This currency mismatch placed cinema operators in a bind: most of their major expenses, including licensing, software, and equipment, are priced in dollars. Global-standard cinema management software, such as Vista Cloud, could cost as much as $80,000 annually. To survive, cinemas passed these costs on to their audiences. Over the last decade, the average cinema ticket price in Nigeria surged by more than 300%, from 1,080 naira to 4,380 naira, effectively pricing out the majority of Nigerians.

Kolade Adewoye, founder of Fusion Intelligence, first became aware of this problem in 2019, during his compulsory national service, when he worked at Filmhouse Cinemas as a business intelligence analyst. “I felt we could have a low-cost alternative for Nigerian cinemas. Maybe within three months, we could have a prototype,” Adewoye told Communiqué. But he would not start building a solution until a few years later.

Following his stint at Film House, Adewoye joined Step Inclusive, a startup that builds payment software for the Lagos State transport sector. When that startup failed, he took what was left of the technical team to start Fusion Intelligence. Fusion Intelligence’s first iteration was as a web development agency, building websites and mobile apps for companies such as Sterling Bank and ABC Transport.

However, the 2023 economic downturn forced the company to rethink its strategy. Instead of running an agency business model with one-off clients who were easily affected by Nigeria’s rapidly changing economic headwinds, it would build digital products that generate recurring revenue. Armed with ₦100 million (around $200,000) raised in a friends and family round, Adewoye began pivoting the business to focus on digital products for the hospitality sector.

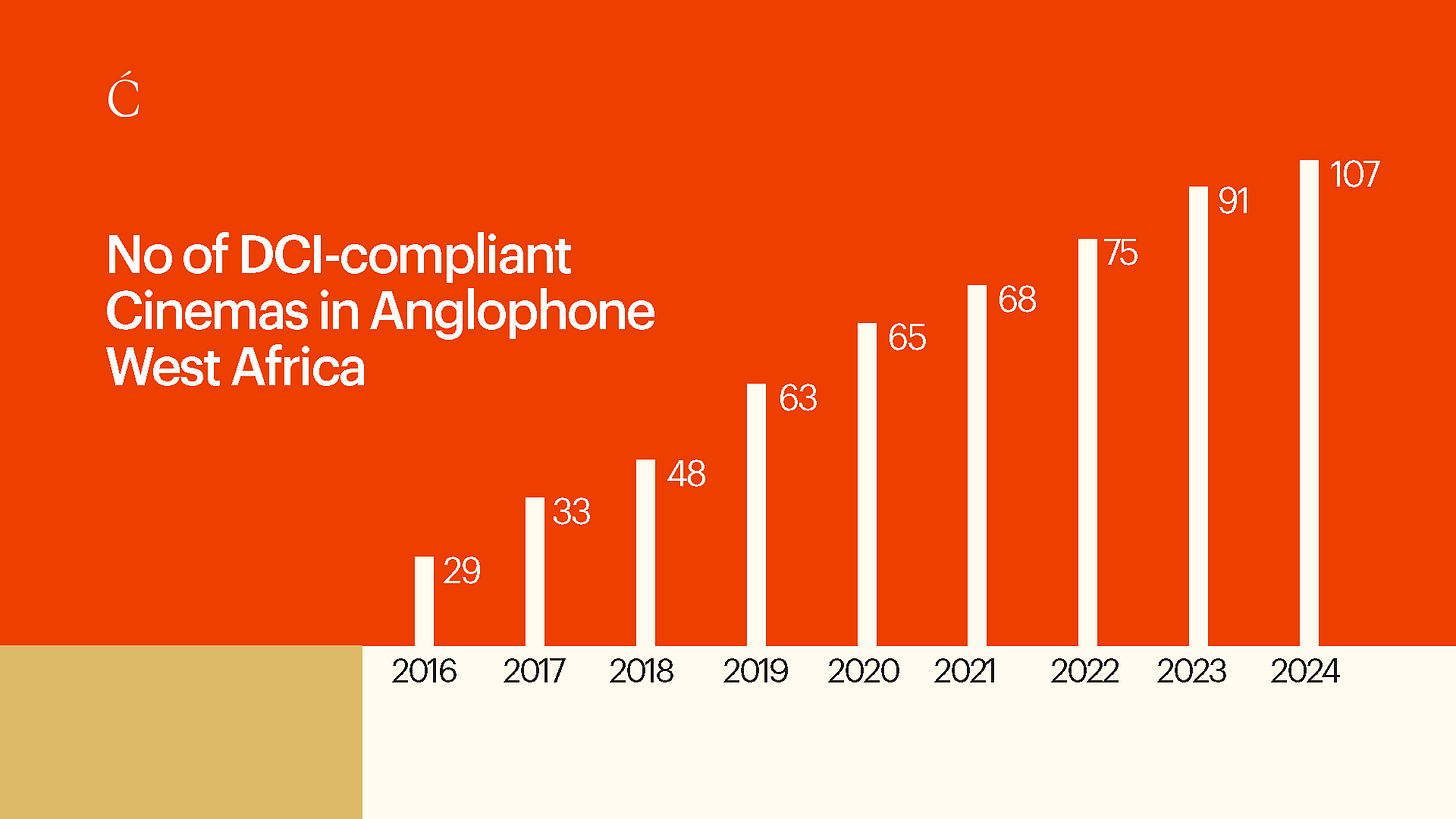

Fusion Intelligence launched REACH, a cinema management software similar to Vista Plus, providing ticketing service for Nigerian cinemas, and Kudos, a box office reporting software for cinemas, enabling them to dispense royalties to distributors the next day. By early 2025, REACH was powering 49% of West Africa’s cinemas, including Ebony Life Cinema, the region’s highest-grossing location. Fusion Intelligence also launched Foodease, a restaurant management software with clients like Pannarottis Pizza and King Lace Ice Cream.

However, with REACH approaching saturation in the Nigerian market, Adewoye began to consider ways to expand the market. That was when he settled on the community cinema model.

3. Nigeria’s community cinema roots

Community cinema in Nigeria dates back to the early 20th century, during the colonial era, when film exhibition first arrived as a form of entertainment and education. The medium began with peephole viewing devices in the late 19th century, then evolved to motion picture screenings by the early 1900s, with some of the earliest films showing at Lagos’s Glover Memorial Hall in 1903.

During the 1930s and 1940s, cinema houses became key social venues in cities like Lagos, operated mainly by companies like the West African Pictures Company. However, the films shown were mostly foreign productions, with little Nigerian content. To counter this, the Nigerian Film Unit, with the aid of mobile cinema vans, began playing educational and health-themed films across the country, screening to millions for free and slowly increasing indigenous Nigerian content. However, as the cinema industry continued to develop, the community cinema model slowly died out, used only during periods of health crises to drive awareness in highly remote areas.

Elsewhere in Africa, the community cinema model has found some success. In 2016, Canal+ launched Canal Olympia, a chain of eco-friendly cinemas across Francophone Africa, which improved on the community cinema model. Instead of just having a cinema hall, Canal Olympia incorporated live performance venues at its locations, turning the cinema into a cultural centre for the community. The model has become very popular, with Canal Olympia opening 18 locations across 12 countries in Francophone Africa, including Benin, Ivory Coast, and Togo.

But when Canal Olympia tried to expand in Nigeria using the traditional community cinema model, it faltered. In December 2020, it opened its first location in Mararaba in Nassarawa State, near the outskirts of Abuja, in a grand ceremony attended by the Governor of Nassarawa State, the French Ambassador, and the Director of the Nigerian Film and Video Censors Board. But the opening fanfare did not translate to steady patronage. Four months later, the cinema manager, Aminu Yahaya, was complaining about the location. “A cinema entertainment of this nature is alien to the people of Mararaba, as they are used to clubs, joints, and beer parlours. We are taking our time to understand the environment to reach out to the people effectively.” In 2023, the location was shut down.

Now Fusion Intelligence is adopting the community cinema model, but instead of rural areas, it’s betting on urban areas. Specifically, locations with already existing foot traffic, such as restaurants and co-working spaces, can be provided with film screenings as an added feature.

4. Fusion Intelligence’s community cinema playbook

To do this, Fusion Intelligence will have to solve another problem: low trust. One of the main reasons community cinema has failed to catch on with commercial distributors and major studios is the fear of piracy. Conventional cinemas are equipped with Digital Cinema Initiatives (DCI)-compliant projectors, which encrypt films using a secure digital key system. These projectors are part of a global anti-piracy infrastructure that ensures a movie can only be played in authorised locations, at pre-approved times. However, DCI projectors are prohibitively expensive, typically starting at $40,000 and reaching as high as $150,000, which presents another barrier for small businesses or community-led initiatives seeking to screen films legally and securely.

To address this bottleneck, Fusion Intelligence built Convoy, a secure cinema distribution technology that allows filmmakers and studios to deliver encrypted films to non-traditional screening locations without compromising copyright protection.

Rather than requiring expensive hardware, Convoy is designed to work with a wide range of projection systems, including lower-cost projectors used in co-working spaces, restaurants, and pop-up venues. According to Adewoye, this opens the door for hundreds of previously unviable screening venues, no longer constrained by DCI hardware requirements, to become cinema outlets. “We are targeting hotels, lounges, restaurants, places where people can go for the cheap tickets and then stay and spend on food and drinks because they believe that they are getting a deal on a night out.”

With Convoy, Fusion Intelligence makes a compelling pitch to both filmmakers and exhibitors: show your film in more places safely, and earn revenue from an entirely new class of venues. Fusion Intelligence will also provide ticketing and box office reporting services for these locations through REACH and Kudos.

“To combat piracy, we have content protection. To combat low trust, we have next-day disbursement of royalties. So with all of that technology and infrastructure in place, we can start meeting people to open up community cinemas.”

Fusion Intelligence’s business model for FilmHub is a hybrid of software licensing and revenue sharing. Locations pay an annual fee of 1 million naira to access Fusion Intelligence’s full suite of products. In addition to licensing, Fusion Intelligence operates a revenue-sharing arrangement in a 40:40:20 ratio—40% of ticket revenue goes to the film distributor, and another 40% to the location operator. Fusion Intelligence takes the remaining 20% cut as the platform provider.

Nile Entertainment has already come on board as a distribution partner, giving FilmHub access to an impressive film library that includes Wives on Strike, Radio Voice, Makemation, and Red Circle. Talks are also underway with other leading distribution companies such as FilmOne Entertainment and Tribe Nation Theatrical Distribution to expand the content catalogue available across FilmHub-powered venues.

A favourable shift in government policy is backing the rollout. In October 2024, the Nigerian Film and Video Censors Board (NFVCB) announced a licensing waiver for investors interested in establishing community cinemas nationwide. This is part of a broader push by the Ministry of Arts, Culture, and Creative Economy to revitalise the local exhibition sector.

Previously, exhibitors had to pay ₦250,000 for a national license and an additional ₦200,000 per film location. Fusion Intelligence was among the first entities to benefit from the waiver, enabling them to open multiple FilmHub locations without the burden of upfront regulatory fees.

Despite its promise, many remain sceptical about the viability of the community cinema model. However, Fusion Intelligence has a few factors working in its favour: secure film distribution through Convoy, flexible infrastructure that lowers costs for exhibitors, and a supportive policy environment. The company is betting these will be enough to make the model work at scale. And Adewoye is optimistic.

“Some people think, maybe this might not make the money we think it would make. Maybe the ticket price is too cheap. And for us, the only job that we have to do is to market it as hard as possible. It’s a make-or-break moment for us. We have to make it work.”

”

This is very interesting as it reminds me of 2018, just after my service year in Lagos.

I had reached out to the distributors of UpNorth to let me do a screening of the movie in Minna (where I grew up).

The one-day screening went okay on my end. I probably broke even as I tried to keep cost very low.

Not so sure on the distributor’s end though as they incurred even more cost trying to protect against piracy. This meant getting someone travel down from Lagos to Minna with the content.

Fusion’s new tech seems to fix this. Very interesting.

(Not sure why Canal couldn’t hack it in Nasarawa 🤔 The feedback I got from the one-time screening in Minna pointed to residents wanting more of that.)