South Africa eyes creator earnings + Ghana’s biggest bank wants TikTok payouts

South Africa’s revenue agency wants influencers to pay taxes; Ghana Commercial Bank wants to be TikTok’s official local payment partner.

Hello!

Monetisation has always been the biggest headache for African creators. Both local and global platforms still lack the structures to pay them, leaving many working hard but earning little or nothing. As today’s Digest shows, government policies can either ease these struggles or make them worse.

A quick note: If you value the insights you get from Communiqué, please consider supporting us by donating here.

In today’s Digest, we discuss

South Africa’s push to tax creators

A local payments partner for Ghanaian TikTokers

Centre Spread 🗞️

The Taxman comes for South African social media influencers

The South African Revenue Service (SARS) has included social media influencers in the tax bracket. Under the country’s Income Tax Act, all income earned by influencers—whether from products, services, travel, or grants—must be declared.

In August, SARS urged influencers to regularise their tax affairs, describing them as “entrepreneurs” who leverage their social followings for income. In a follow-up statement on September 6, the agency reiterated its stance, stressing that it will first help influencers understand how to comply before applying penalties. Commissioner Edward Kieswetter emphasised that while SARS aims to provide clarity, influencers must also “uphold their end of the bargain.”

The development mirrors Kenya, where recent amendments introduced new taxes on creators earning through YouTube, TikTok, and Instagram. The move has drawn criticism for applying an Excise Duty Tax, traditionally designed to curb harmful consumption, to the digital economy. Creators and analysts argue that such taxes ignore the unique nature of online work and could stifle a fast-growing sector that provides income for young people.

Beyond Africa, governments are taking similar steps. The trade-off for public investment in e-commerce infrastructure and digital policies is that tax obligations follow. With rising fiscal pressures, authorities worldwide, including in the U.S., are expanding revenue bases to capture earnings in the creator economy. Kenya’s President William Ruto defended the approach in December 2024: “Some creators now earn up to Ksh 1 million. Someone earning Ksh 20,000 or 30,000 pays tax. If you earn Ksh 1 million, isn’t it correct to contribute something to the tax kitty, especially when we’ve enabled you to achieve that? I think that makes sense.”

Ghana Commercial Bank wants a piece of TikTok’s funds

Ghana Commercial Bank (GCB) is lobbying to become the designated payment gateway for the country’s TikTok creators. On Monday, bank officials reportedly met with Communications Minister Samuel Nartey George to pitch a framework that would allow creators to receive TikTok earnings directly through local banking channels.

The bank argued that its partnerships with Mastercard and Visa position it well to manage payouts. TikTok has said it will examine the feasibility of the proposal.

The move highlights a long-standing challenge: TikTok relies on processors like Stripe, which is unavailable in most African countries, weakening the continent’s position in the digital economy. GCB’s push is notable because it seeks to fill this gap.

But payments are only part of the problem. The TikTok Creator Rewards program, which pays eligible creators, is unavailable in Africa. The TikTok Creator Marketplace, which connects brands with influencers, is also limited. Currently, only Morocco, Egypt, and South Africa access some form of payout scheme through the TikTok Effect Creator Rewards program, which operates in just 53 regions worldwide.

Even if GCB succeeds, few Ghanaian creators would qualify for payouts. About 52,021 creators in Ghana meet the 10,000-follower threshold for the Creator Rewards program, while only 4,676 accounts surpass the 100,000 followers required for the Marketplace. By contrast, Nigeria counts 203,485 creators with over 10,000 followers and 16,287 with over 100,000.

Globally, TikTok has not announced any official partnerships with traditional banks like GCB. Still, solving the payments bottleneck could be a crucial step toward unlocking wider monetisation for African creators and sparking more local interest in TikTok. For now, all eyes are on how the platform responds.

Crunch Time 📈

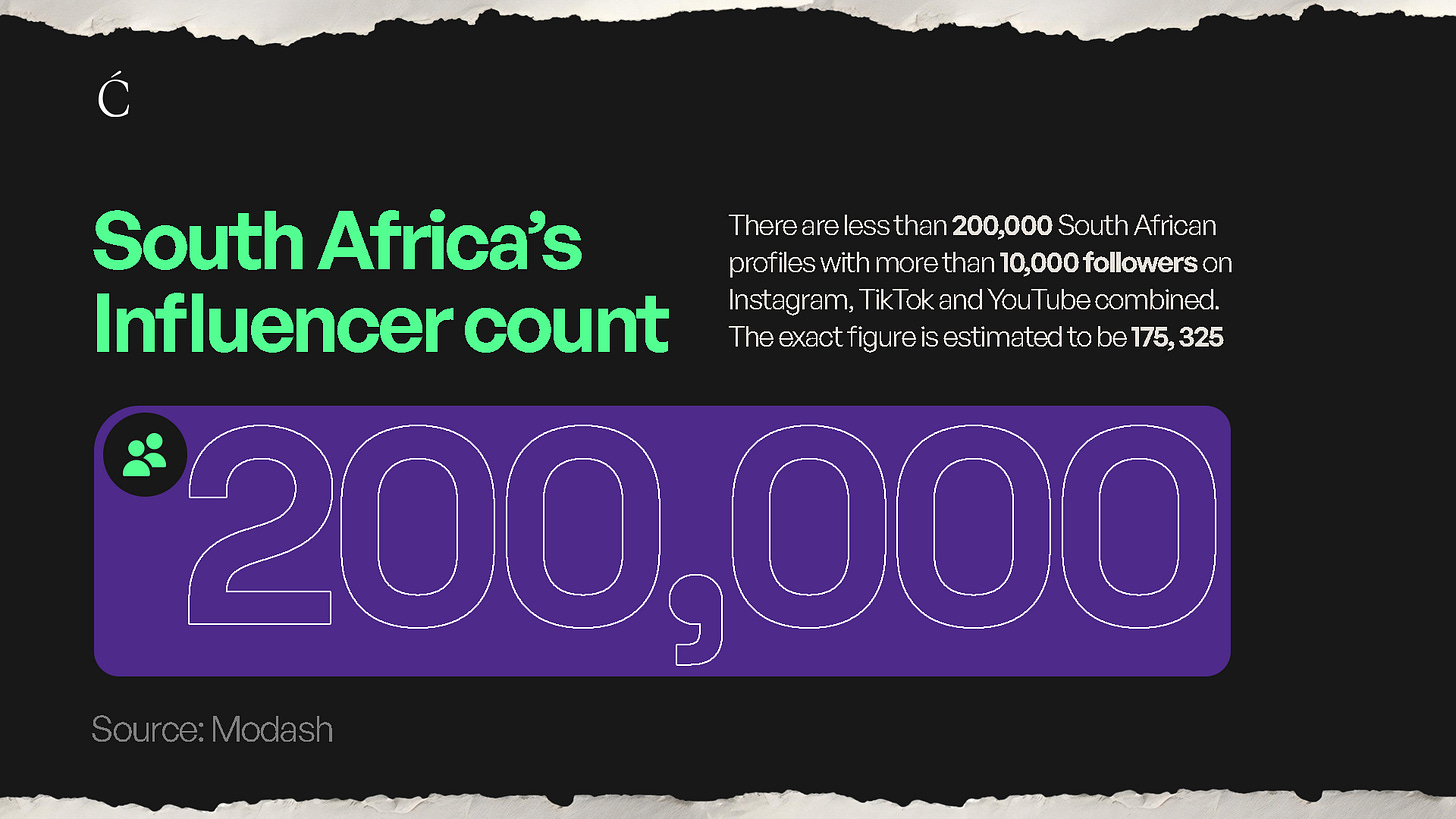

The size of South Africa’s influencer pool

Catch Up 📬

The results of Fusion Intelligence’s community cinema project pilot are out

The ambitious community cinema project gives us a glimpse of another dimension of the trade-offs between content protection and user experience. This week’s Communiqué essay digs into what went right, what went wrong, and the lessons for Nigeria’s film distribution future.

Here is an excerpt for you:

“Fusion Intelligence had over-indexed on security with Convoy. The platform allowed producers to upload their films, have them encrypted, and securely stream them to authorised locations with unique decryption keys. On paper, this solved Nollywood’s greatest fear: piracy. But in practice, Convoy’s security system created a broken viewing experience.”

Read the full essay here.

Curiosity Cabinet 🗄️

Ogelle, a short-lived African version of YouTube, might be coming back. The founder, Osita Oparaugo, hinted at this in this personality feature by TechCabal.

Antia Ebiogbe, Big Cabal Media’s Chief Operating Officer, this week’s Offscript guest, tells us how she is building her career in the media industry by harnessing chaos to do big things.

Here is what is happening in Africa’s creative economy this weekend and next week:

13 September: Naija AI Film Festival 2025 in Lagos

16-18 September: Africa Film Finance Forum (AFFF) Summit 2025 in Lagos

16-19 September: Africa Creative Market in Lagos.

Explore more of Africa’s creative economy in one place. Communiqué’s African Creative Economy Database tracks 1,000+ companies, events, investors, and government actors across the continent.

That’s it for this week’s Digest. See you next week.

Editorial Update: An earlier version mistakenly referenced the TikTok Creator Fund instead of the TikTok Creator Rewards Program. The Creator Fund was discontinued in 2020 and replaced by the Rewards Program.

Could someone explain to me how any African government policies contribute to creator earnings that give them authority to tax said earnings?? I’m asking for real. T for thanks!