MultiChoice’s survival math + Africa’s anti-piracy battle heats up

MultiChoice is cutting prices for its decoders; fresh piracy crackdowns expose the deeper fight for Africa’s entertainment market.

Hello!

First time reading anything Communique? Join over 49,000 readers who rely on us as the knowledge bank of Africa’s creative economy. Sign up here.

Don’t keep us a secret: tell your friends to sign up too. And, as always, send us feedback here.

In this week’s Digest, we discuss:

MultiChoice’s decoder price cuts

The war against content piracy in Africa

Centre Spread 🗞️

Will price cuts solve MultiChoice’s customer loss crisis?

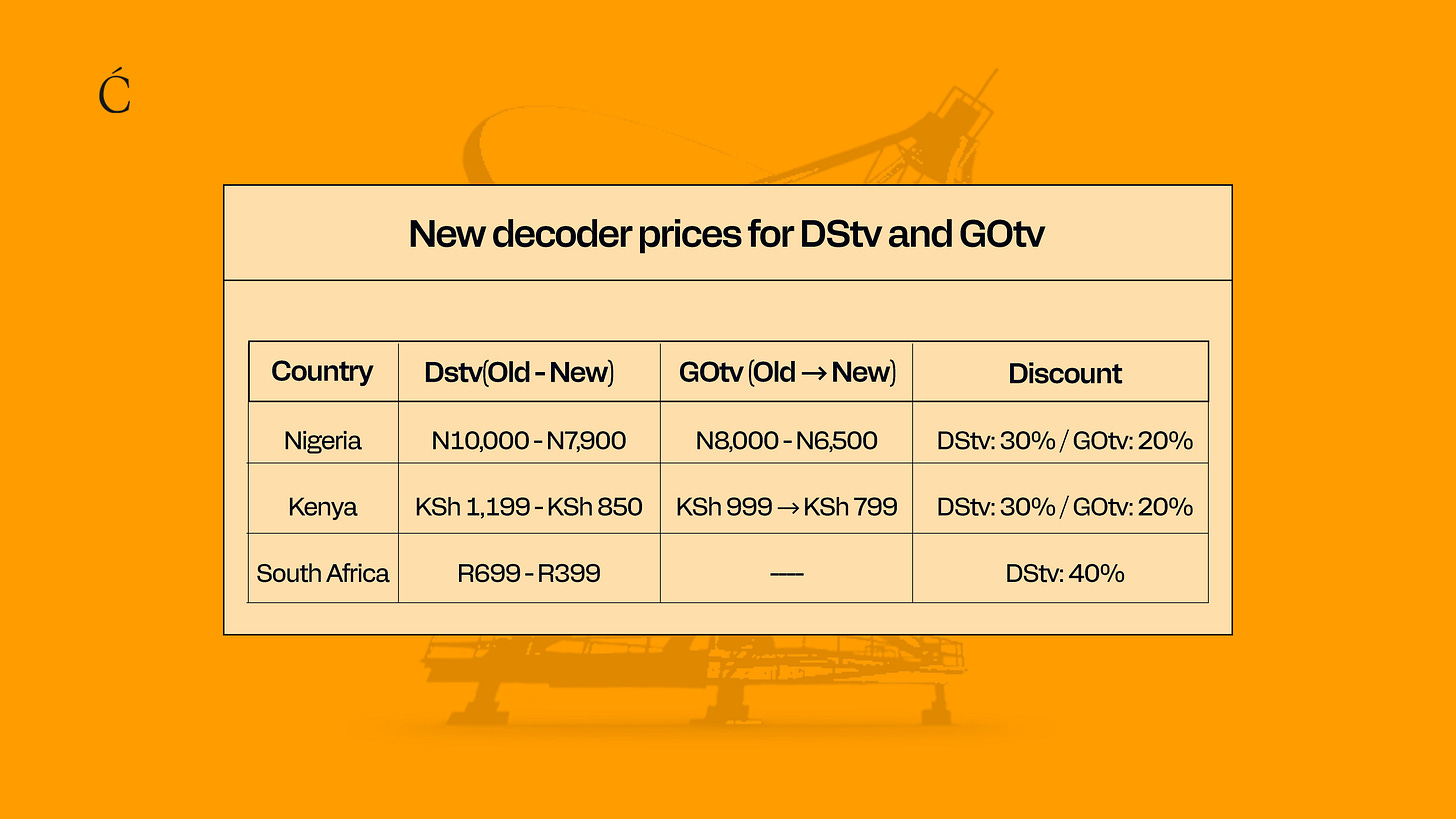

In the past three weeks, MultiChoice has announced significant price cuts for its DStv and GOtv decoders across its three largest African markets: Nigeria, South Africa, and Kenya. In these markets, the price for the hardware is down by about 30% for DStv and 20% for GOtv.

The company says these cuts are part of a limited-time promotional offer. Dish kits and antennas have also been discounted, with the promotion running until the end of December 2025.

In South Africa, the company has reintroduced Open Time, a long-standing company tradition that grants its decoder users temporary access to DStv Premium content, including sports, movies, and entertainment channels. The move is clearly aimed at enticing existing users to upgrade to higher tiers while drawing new customers to the platform.

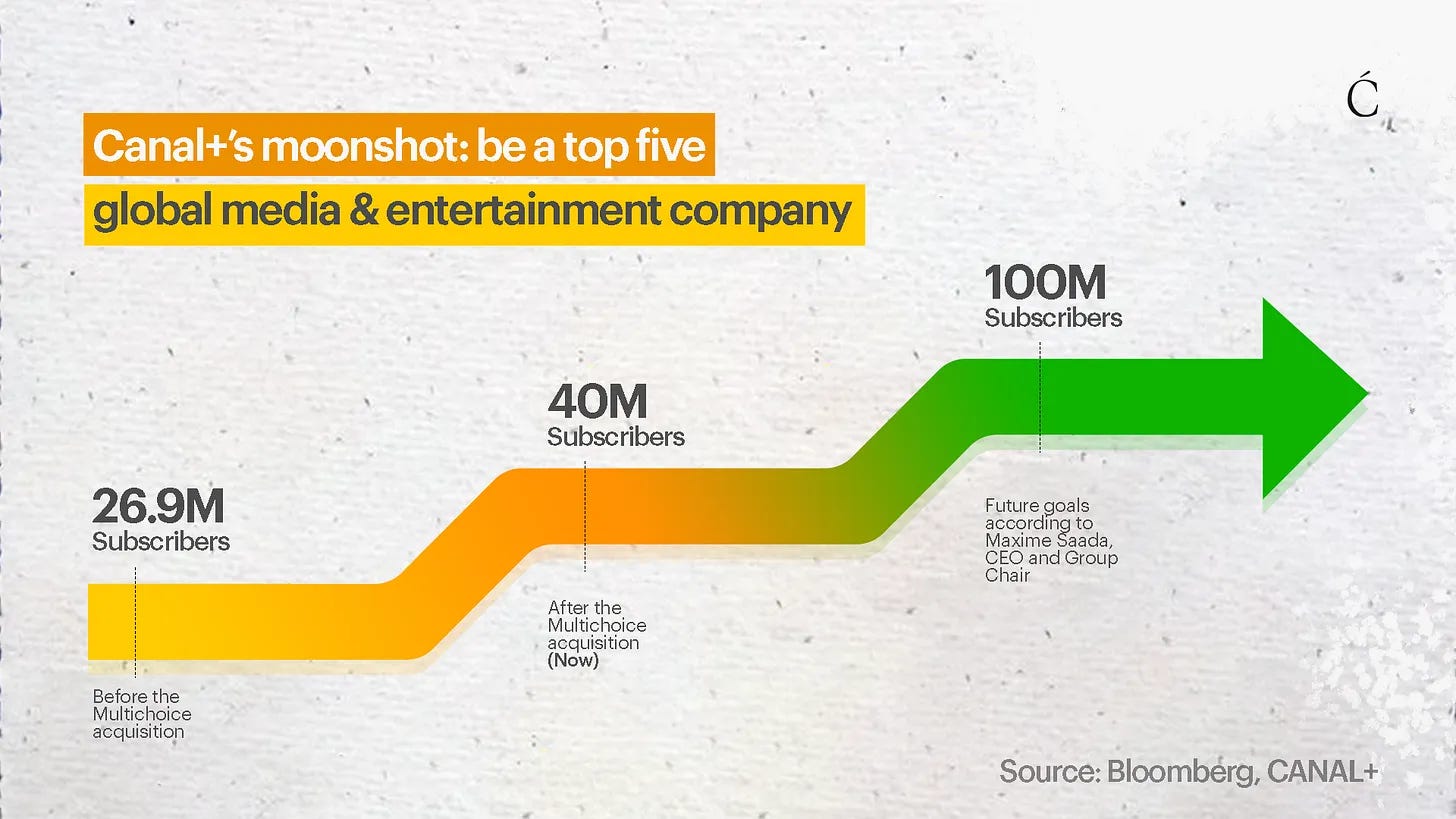

The move is the latest from the pay-TV operator under its new management, CANAL+. On paper, these tactics make sense: lower hardware prices and short-term access perks could expand reach and reignite interest. However, in markets like Nigeria, where inflation and economic instability have eroded disposable income, affordability, rather than access, is the real barrier. Many households that already own decoders have stopped subscribing to services. Entertainment has become a luxury, and essentials like food, rent, and fuel now take priority.

Notably, the new management has said it has “bigger plans” to be unveiled early next year. There’s talk of developing a “super app” that combines all of CANAL+ assets across the continent to create a platform meant to compete more directly with global giants like Netflix.

Still, price cuts and new platforms may not be enough. MultiChoice (and, by extension, CANAL+) must find ways to make its content more relevant and its services more affordable in markets where YouTube, TikTok, and social media platforms already dominate attention, and where economic hardship is forcing audiences to choose between staying connected and staying entertained.

The war on content piracy is heating up in Africa

Speaking of alternative ways Africans access entertainment, the popularity of online streaming platforms offering copyrighted movies and TV shows for free—or at minimal cost—has surged across the continent. But so too has the fight against them.

This week, My Family Cinema, one such service popular in South Africa, reportedly informed users it was shutting down permanently. The shutdown has been linked to a recent crackdown on piracy operations in Argentina. The service was among the sites affected by the joint operation. In Nigeria, authorities have also stepped up enforcement. The country’s communications regulator recently suspended MovieBox.ng, a similar platform. Last month, two individuals were arrested for allegedly rebroadcasting DStv and GOtv content without authorisation.

No company has been more outspoken than MultiChoice, which says piracy poses an existential threat not only to its business but also to the broader ecosystem of African creators it supports. In April, the pay-TV giant secured a court order to shut down pirate streaming operation Waka TV for distributing its content unlawfully. It has since intensified its anti-piracy push, joining the Partners Against Piracy (PAP) initiative and working with cybersecurity firm Irdeto to track and shut down illegal networks across multiple countries. MultiChoice has also begun outreach programmes in schools to discourage young people from engaging in illegal streaming.

Piracy is a global issue, but it is particularly prevalent in Africa. A 2021 Irdeto survey found that the top ten piracy websites received 17.4 million visits from users in just five African countries over three months. MUSO’s 2023 survey showed an 18% rise in such visits since 2021. MultiChoice blames weak copyright laws and the widespread perception that piracy is a victimless crime.

The cultural expectation of free entertainment continues to hinder Africa’s creative economy. The real challenge lies in creating affordable, accessible legal options that make piracy not worth the trouble.

Crunch Time 📈

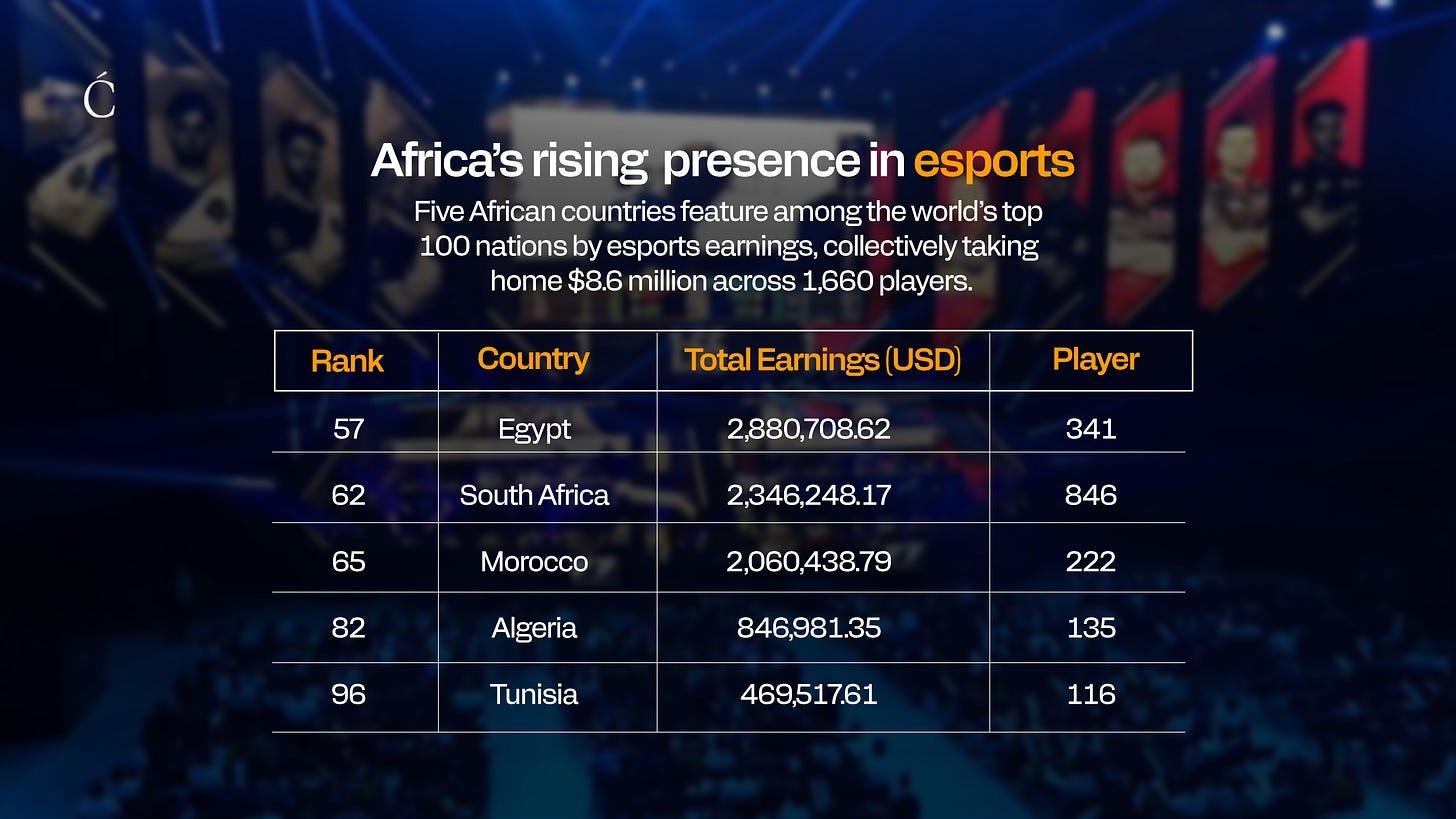

Africa’s rising presence in esports

Curiosity Cabinet 🗄️

The Music Business Academy for Africa now has a new mission: to help professionalise Africa’s creative economy. This week’s Communiqué essay traces the Academy’s growth to date and explains why this evolution makes perfect sense as its next chapter.

In this week’s edition of Offscript, Raymond Malinga, co-founder and CEO of Uganda’s Creatures Animation Studio, shares how he built one of East Africa’s largest animation studios.

Here are the events happening across Africa’s creative economy this weekend and next week:

November 10 – 13: Africa Tech Festival holds in in Cape Town, South Africa.

November 10 — 13: Lagos Arts and Book Festival holds in Lagos, Nigeria

November 12– 14:Ghana Digital & Innovation Week (GDIW) holds in Accra, Ghana

Over 500 business leaders and investors are gathering at the Counder Conference 2026 to discuss how to support the next generation of cultural and creative entrepreneurs.

Explore more of Africa’s creative economy in one place. Communiqué’s African Creative Economy Database tracks 1,000+ companies, events, investors, and government actors across the continent.

Thank you for reading Communiqué! Please help us give Africa’s media and creative industries the coverage they deserve by making a donation here.

That’s it for this week’s Digest. See you next week.