Communiqué 95: SABC’s streaming gamble

After a decade of losses, South Africa’s public broadcaster is banking on its streaming platform, SABC+, to turn the tide.

Why this matters

SABC+ shows how public broadcasters can reinvent themselves through streaming to reach digital audiences and diversify revenue.

The platform’s rapid growth to 1.5 million users signals rising demand for accessible, local streaming alternatives in Africa.

SABC’s digital transformation shows that survival in the streaming age requires more than just content; it demands infrastructure, innovation, and the courage to rebuild from within..

1. Profit and loss

Last month, the South African Broadcasting Corporation (SABC) released its annual financial statement for the year ending 31 March 2025, and the results painted a picture of a broadcaster in transition. For the tenth consecutive year, the national broadcaster reported a net loss, as a 3% increase in expenditure outpaced its modest 1.3% rise in revenue.

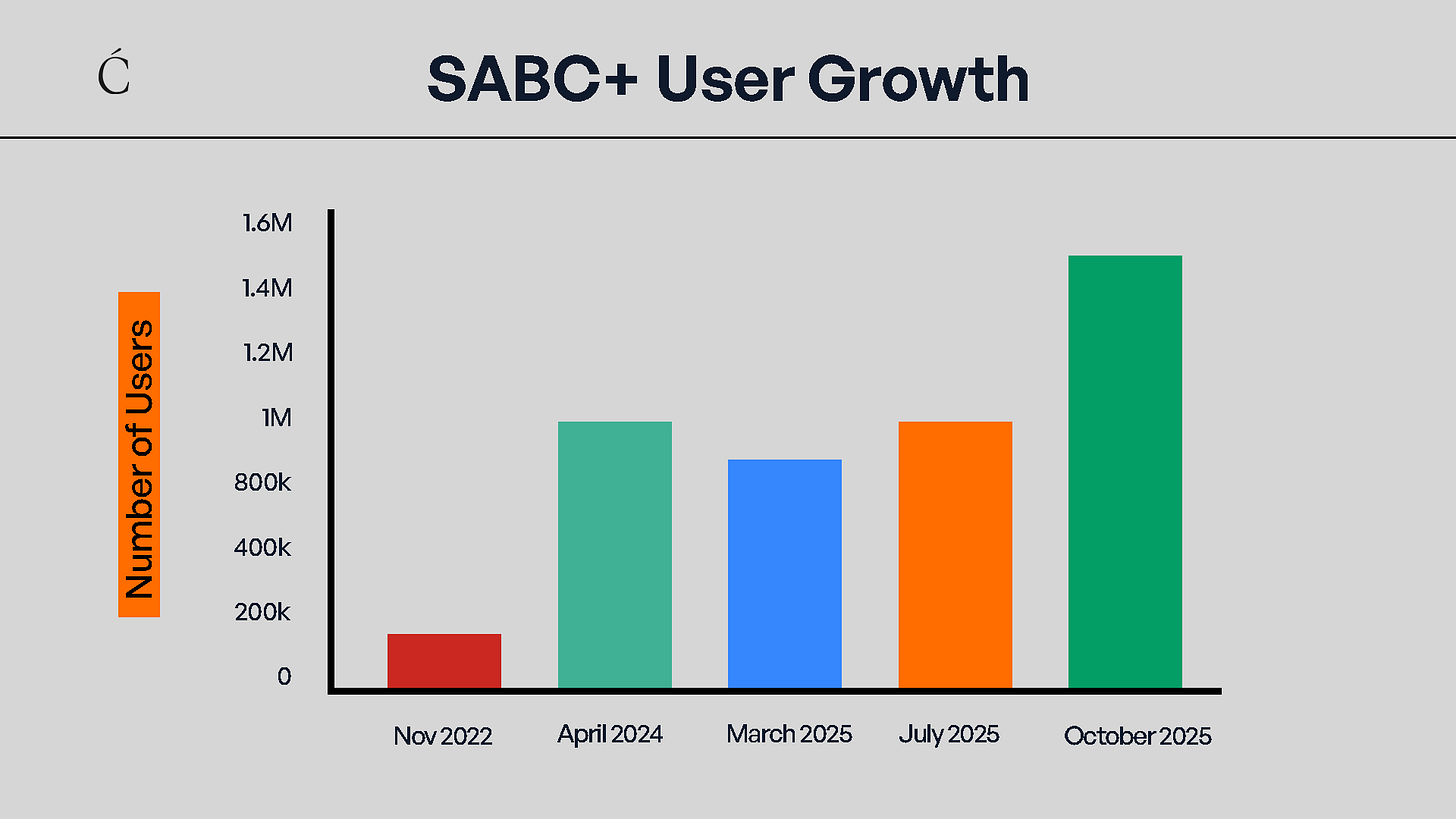

Yet, beneath the sobering financials lay a far more optimistic story. SABC’s digital platforms delivered high levels of engagement, garnering 1.48 billion lifetime YouTube views and a 290% year-on-year surge in podcast downloads. Meanwhile, its streaming platform, SABC+, surpassed 850,000 registered users by March 2025 and has since crossed 1.5 million, a milestone powered by the addition of new channels and spikes in viewership during major sporting events. The numbers are proof of the success of SABC’s ongoing digital transformation efforts. Central to this effort is SABC+, the broadcaster’s over-the-top (OTT) streaming service.

In Communiqué 74, we noted that: “Reinventing a public service broadcaster rests on two core pillars: content and technology. Content is the heart of any broadcaster’s relevance. For a public broadcaster to survive and thrive, it must invest in programming that speaks directly to the realities, values, and aspirations of its audience. The second pillar is technology. As audience habits shift away from traditional TV, public broadcasters must follow the audience where they are — online. Broadcasters worldwide have responded by building robust digital platforms to serve on-demand content.”

For many public service broadcasters, reinvention begins with content: modernising storytelling, commissioning original programming, and developing new formats for digital audiences. But SABC has taken a different approach. Rather than starting with programming, it began by fixing the plumbing, investing in the technology that underpins digital delivery. With SABC+, the South African broadcaster has chosen to lead with infrastructure: building a platform capable of carrying the institution into the streaming age.

What began as a complementary digital channel is slowly becoming the cornerstone of how SABC distributes content, engages audiences, and experiments with new revenue streams.

2. A broadcaster at crossroads

Like many Anglophone African government services, the SABC was modelled after its British counterpart, the BBC. SABC inherited not only the British public service ethos but also its funding architecture, the television licence system.

Under this model, every household that owns a TV set is required to pay an annual licence fee, the proceeds of which are meant to fund public broadcasting in the public interest. In theory, the system protects editorial independence by insulating broadcasters from political interference. In practice, however, the model has struggled to survive in the digital age.

As South African audiences have migrated online, compliance with licence payments has collapsed. According to the SABC’s 2025 annual report, only around 16% of households pay their licence fees, leaving billions of rands in uncollected revenue each year. The result is a massive and widening funding gap. This structural deficiency makes it difficult for the SABC to invest in new programming, technology, or talent at the same scale as its commercial competitors. To stay afloat, the broadcaster has had to rely increasingly on advertising and government bailouts.

But the SABC’s constraints are not just about declining licence revenues. The broadcaster also operates in a restrictive regulatory environment. Under South Africa’s Broadcast Digital Migration Policy of 2008, the SABC is compelled to use digital terrestrial television (DTT). This system sends TV signals through ground-based transmitters rather than via satellite or internet-based platforms. The regulation mandates that 84% of SABC’s transmission must run on DTT infrastructure managed by the state-owned signal distributor, Sentech. While this structure was designed to ensure universal access to public broadcasting, it has become a burden.

Maintaining DTT infrastructure is expensive, and the policy effectively prevents the SABC from pursuing cheaper, more scalable alternatives, such as direct-to-home (DTH) satellite transmission. This dependency on terrestrial broadcasting has eroded the corporation’s competitiveness, particularly as private rivals like MultiChoice and Netflix have built flexible, multi-platform ecosystems that reach audiences wherever they are: on phones, smart TVs, or laptops. Constrained by dwindling revenues and the limitations of terrestrial infrastructure, the SABC began to see digital streaming as an alternative to diversify income beyond the collapsing licence system and reconnect with an increasingly digital audience that had long drifted from traditional TV.

“What we don’t want to do is lose our linear audience. We actually want to provide them with an alternative viewing option of our content. Instead of losing them, we’re migrating them,” SABC’s former COO, Ian Plaatjes, said to Variety at the launch of SABC+.

3. The devil in the details

SABC’s first foray into streaming began as a partnership. In 2020, the broadcaster teamed up with state-owned telecommunications provider Telkom to launch TelkomONE. The new platform merged the strengths of both institutions. Telkom provided the infrastructure, bandwidth, hosting, and technical support, while SABC contributed the content.

The platform adopted a freemium model. Users could register for free to access a limited catalogue of live news, entertainment, and inspirational content, while premium offerings, such as music, short films, and TV series, were available behind a paywall. But by 2022, just two years in, Telkom decided to discontinue the service, citing a need to refocus on its core telecom operations. SABC took full ownership of the platform and rebranded it as SABC+.

The timing proved fortuitous. SABC+ launched just ahead of the 2022 FIFA World Cup. The tournament provided the perfect launchpad, driving massive user sign-ups.

SABC+ adopted an advertising-supported video-on-demand (AVOD) model, instead of continuing with the freemium subscription video-on-demand (SVOD) model that TelkomONE had used. This pivot proved critical. MultiChoice held exclusive rights to major tournaments like the Cricket World Cup and the Rugby World Cup, two of the biggest sports in South Africa. By removing the paywall, SABC+ provided access to premium sporting content to millions of South Africans who had previously been priced out.

A rebrand in December 2023 introduced a sleeker design and enhanced streaming quality to SABC+, resulting in a surge in user growth. By April 2024, the platform had reached 1 million users, up from the 150,000 it inherited from TelkomONE. Then it had to start all over again.

The SABC+ platform was managed by Discover Digital, a South African media company, which had previously managed TelkomONE. For its services, Discover Digital was paid R35 million. However, SABC claimed that its then COO, Ian Plaatjes, Head of digital, Francois Naicker, and Sales Head, Reginald Nxumalo, had hidden a clause allocating 7.5% of the advertising revenue generated on SABC+ to Discover Digital, despite presenting to the board that SABC would retain 100%.

The fallout was swift. The implicated executives were dismissed, and SABC began to rebuild SABC+, this time partnering with Dubai-based streaming technology provider Mangomolo. Mangomolo had helped launch streaming services for platforms like Discovery Networks, Orange Telecom, and Dubai Media.

In July 2024, the broadcaster relaunched SABC+ for the second time. The new platform grew rapidly, hitting 1 million users by May 2025 and 1.5 million by October. Monthly revenue rose from R100,000 in April 2024 to R700,000 by March 2025.

4. The endgame

SABC’s streaming ambitions have also followed closely with those of the BBC. In 2009, when the BBC launched its streaming service, BBC iPlayer, it was a free offering accessible to anyone in the UK with an internet connection. However, from September 1, 2016, a TV licence became a requirement to watch content on iPlayer. Even that has proven insufficient. In January of this year, Bloomberg reported that the UK was considering making households that only use streaming services, such as Netflix and Disney+, pay the BBC licence fee as part of plans to modernise the way it funds the public-service broadcaster.

When the SABC broached a similar idea in 2021, it was met with stiff resistance from streamers like Showmax, who argued that such a policy would unfairly burden digital streamers. Still, the idea speaks to the dilemma facing legacy public broadcasters worldwide: how to sustain a universal service mandate in an era where audiences are increasingly fragmented and consumption habits vary.

Nevertheless, SABC+ sits at the centre of a five-year strategic plan that the corporation hopes will return it to profitability by 2027. For now, the platform remains free, but that may not be the case for long. In the future, the broadcaster may link SABC+ user registrations to the television licence. A move that would compel South Africa’s millions of digital viewers to pay their dues and help close the funding gap.

SABC’s digital transformation has already begun to show signs of success in South Africa. Ultimately, it could provide a blueprint for how public media in Africa can reinvent itself for the streaming age.

Thank you for reading Communiqué! Help us give Africa’s media and creative industries the coverage it deserves by making a donation here.