Communiqué 54: Why Nigeria’s film industry has struggled to go global

Industry-wide changes from the late 1980s helped Nigeria’s film industry grow. But those same systems have limited its international reach. Times have changed, so what can Nollywood do differently?

1. A turning point

In 2024, Nigerian movies outsold Hollywood movies locally for the first time, reversing a longstanding trend. Until that year, filmgoers in the country had consistently chosen to watch foreign movies over local titles.

This trend reversal helped drive a record ₦11.5 billion in ticket sales, a 60% increase from the ₦7.2 billion made in 2023. A significant price hike in movie tickets drove the growth as the industry adjusted to an inflation rate of over 33%.

While the price hike took the films beyond the reach of many Nigerians, those who remained steadfast opted to watch more local films. This small victory for the industry raised an important question: If Nigerian films were finally gaining more traction than foreign films at the local box office, had the time come for them to crack the international market?

Nollywood, as Nigeria’s film industry is famously called, has been touted by many as a global giant. In 2009, UNESCO declared it the second-largest in the world, surpassing Hollywood and second only to Bollywood. But this characterization was based on quantity—the number of films produced within the industry during the year. While quantity is an important metric for success, there are more important indicators like quality and global commercial viability. In this area, Nigeria's film industry has performed poorly.

2. What does success look like?

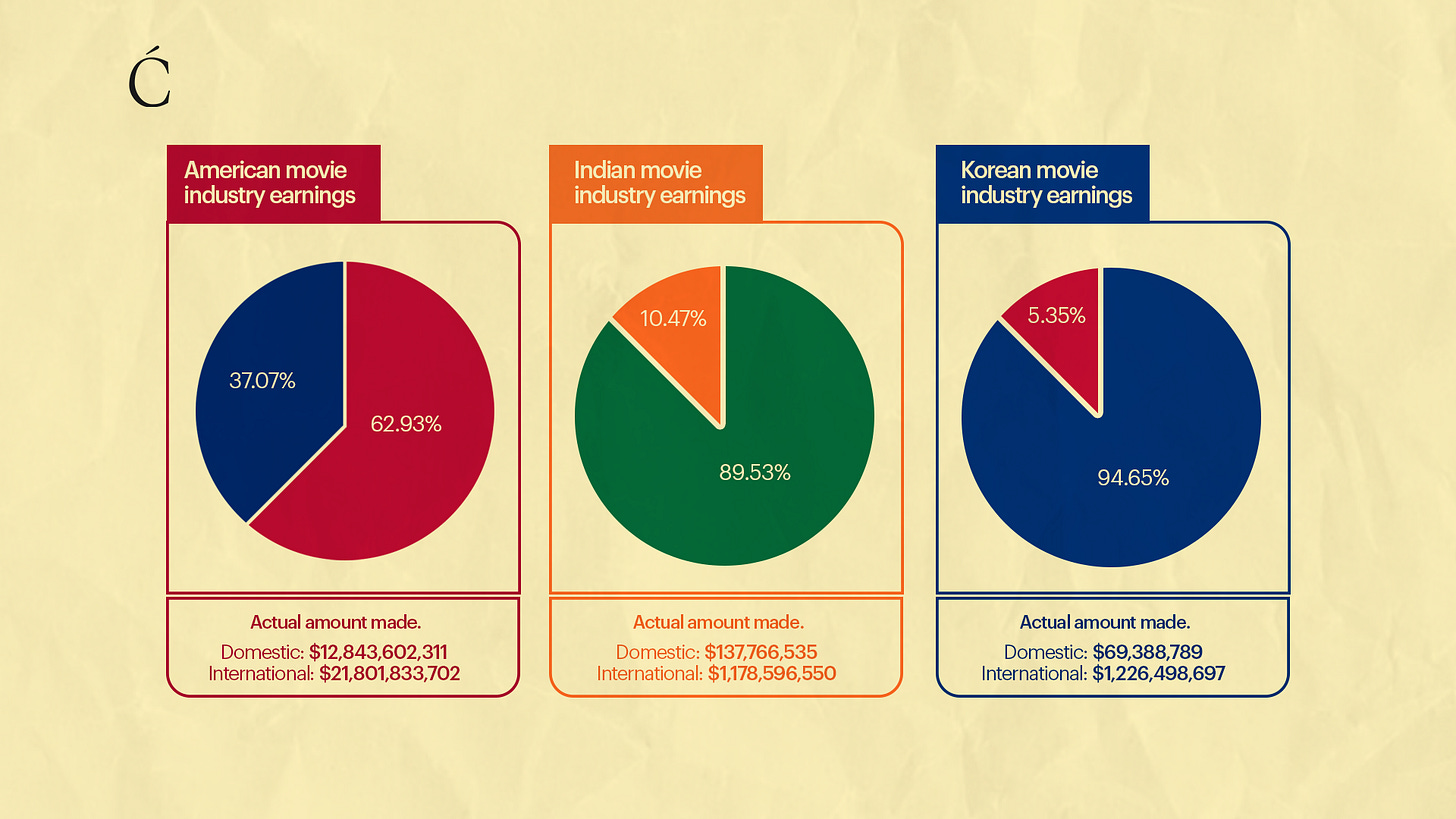

For a country’s movie industry to achieve global success, it must be successful outside its home market. In the U.S., for instance, the 20 highest-grossing movies have accumulated $34.6 billion, of which $21.8 billion came from foreign markets. The success of India’s film industry, Bollywood, has also been largely based on the performance of its films in foreign markets. Its 10 highest-grossing movies have made $1.3 billion—$200 million locally and $1.1 billion internationally. South Korea has also executed a similar crossover with its film industry. Of the $1.29 billion its 10 highest-growing films have generated, 95% ($1.22 billion) has come from the international box office.

Nollywood, on the other hand, has had limited success producing breakthrough films that resonate commercially with global audiences. None of its highest-grossing films has made any significant revenue outside the country.

3. La raison de la situation

Nigeria underwent a structural adjustment program in the late 1980s that transformed its foreign exchange and trade policies. The resulting inflation and currency devaluation hit the cinema and film industry particularly hard. Cinema operators found it difficult to maintain their facilities and import new films as middle-class Nigerians, the primary customers, could no longer afford tickets.

The film industry began developing against this backdrop, prioritizing a direct-to-consumer distribution model that excluded the cinema middlemen altogether. This model favored high-volume, low-cost, low-quality productions distributed via VHS tapes and later CDs for home viewing. It worked for the status quo and even benefitted a section of the industry at that moment. But that singular decision has become the bane of the industry’s existence.

Unlike in the U.S., where the film industry was built around theatrical releases, Nigeria never developed the infrastructure and industry relationships needed for wide theatrical distribution. As of 2024, Nigeria had only 300 cinema screens serving over 200 million people. For comparison, India has over 9,000 screens, and the U.S. has over 40,000. This historical pattern made it difficult for the country to develop a strong local box office, and this came with dire consequences.

There's a symbiotic relationship between local and international box office success. International distributors rely on home box office figures to predict international outcomes. Without strong performance in the domestic market, it’s difficult to generate box office numbers that would attract international distributors or justify the marketing budgets needed for global releases. Nigeria's total revenue from its box office in 2024 is essentially the same as the amount generated on the opening day of some films in other markets. This means that international distributors simply do not consider the industry significant enough.

4. The false promises of the streaming era

The direct-to-consumer model on which the Nigerian film industry was built was the precursor to streaming. Netflix started as a mail-order business, delivering movies on CDs, before its pivot to streaming in 2007. By the early 2010s, its growth in the U.S. market slowed as its core demographic became saturated. So, it turned to the international market for salvation, expanding into Europe and Asia.

Netflix officially arrived in Nigeria in 2016, and Amazon Prime Video followed in 2022. Both came with gifts—increased financing for local productions and talent training—and raised expectations that the production quality of Nigerian movies would finally catch up with the rest of the world. The streaming services’ mission was twofold: to gain new subscribers and tap into Nigeria’s film market for content that appeals to a global audience. They were disappointed on both counts.

The first mission has failed as Nigeria, despite its large population, lacks the economic stamina to contribute significantly to streaming service subscriber numbers. Upon realizing this, Amazon Prime Video exited in 2023. The jury is still out on the second mission. There have been successes like King Of Boys and The Black Book, which garnered 5.8 million views within 48 hours of release and spent three weeks on Netflix's Top 10 English language titles globally, peaking at number three in the second week. But The Black Book is an outlier; most Nigerian films on the platform have underperformed. In 2024, Netflix scaled down its investment in the country as part of a global strategy change, opting to license already-produced films instead of commissioning originals from scratch.

The economic challenges of the 1980s forced Nigeria’s film industry to innovate, leading to the direct-to-consumer distribution model that became the foundation of Nollywood. By circumventing traditional cinema distribution, the industry flourished in volume, establishing itself as a cultural force despite its limited infrastructure. However, this forced change meant that the industry has been unable to invest in the systems and infrastructure that make international commercial success possible. Relationships with international distributors remain infantile, with very little progress in the past few decades.

The same economic challenges that plagued the country in the 1980s still exist, but the industry’s direct-to-consumer fix to the distribution problem is no longer adequate. Neither was the attempt to paper over the cracks with streaming partnerships. For this industry to successfully crossover and become a global commercial success, it cannot afford to ignore the international box office. But for the international box office to respond positively, the local market has to fix itself.

A classic chicken and egg situation. But Nollywood has already proven its capacity to thrive under pressure. With focused investment, partnerships, and an openness to learning from successful global industries, Nigeria’s film industry can turn its current limitations into a springboard for global success, just as it did before.

In essence, Nollywood needs to reinvent itself again. It needs to tell stories and make movies that Nigerian would want to see (and would be able to see) while increasing its appeal on the international stage.

A little thought experiment tho: what if 2024 was an anomaly? Personally, I had little inclination to see any blockbuster from Hollywood; they didn't resonate. What if most moviegoers felt like that and decided to just see local movies?

While I think it is a good thing we are thinking about this, the sector has to retain this success year over year. A 60% increase is suspiciously interesting.

BTW, this was a good read. Thanks!