Businessfront trims workforce + ANKA’s foreign takeover

Layoffs at Businessfront highlight challenges in scaling its niche media strategy; ANKA’s sale raises fresh questions about control in Africa’s fashion value chain.

Hello!

It’s the penultimate week in October, and that means this is your last reminder to secure your tickets for Communiqué IRL, the Jo’burg edition. It is happening on October 30, and we’re bringing together voices from South Africa’s creator class to discuss how they built their space and where the industry goes from here. Tickets are free, but seats are limited. If you haven’t registered yet, please do now, here.

First time reading anything Communique? Join over 49,000 readers who rely on us as the knowledge bank of Africa’s creative economy. Sign up here.

Don’t keep us a secret: tell your friends to sign up too. And, as always, send us feedback here.

In this week’s Digest, we discuss:

The layoffs at Businessfront

What ANKA’s sale means for African fashion.

Centre Spread 🗞️

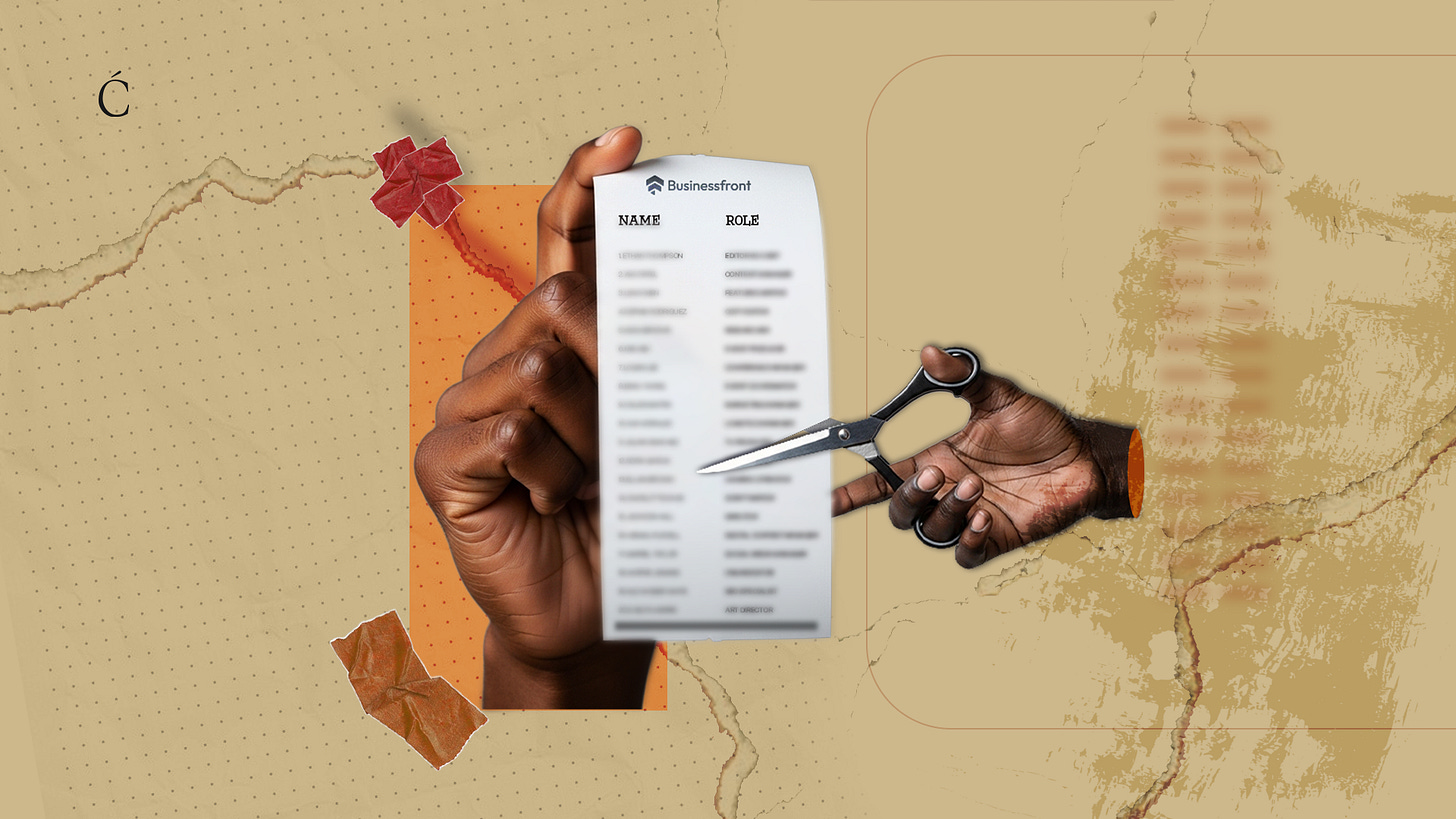

Businessfront lays off staff months after expansion into new verticals

Businessfront, publisher of Techpoint Africa, Finance in Africa, and Energy in Africa, has laid off an undisclosed number of employees across the group. The move, first reported by TechCabal, is part of a restructuring process aimed at ensuring “long-term sustainability” and “sharpening strategic focus.”

In an emailed statement to TechCabal, Businessfront CEO Múyìwá Mátùlúkò confirmed the layoffs, describing them as “limited” and noting that all Businessfront brands remain fully operational. “All brands and emerging products, including Techpoint Africa, remain fully operational, and we continue to serve our audiences and clients without interruption,” he said, without disclosing how many roles were affected or what support would be offered to the affected staff.

Earlier this year, Businessfront expanded its publishing portfolio with the launch of Energy in Africa and Finance in Africa, two new titles aimed at deepening the company’s presence across business sectors beyond technology. The expansion was part of a broader strategy modelled after Industry Dive, the U.S.-based B2B publishing group known for its network of highly targeted industry publications. Businessfront’s goal was to replicate that approach in Africa by building niche publications serving specific verticals such as energy, finance, FMCG, etc.

However, the cost of running multiple editorial teams in a media market constrained by the rise of artificial intelligence, declining referral traffic from Google Search, and a shrinking advertising market has proven challenging, particularly without raising new capital. Techpoint Africa, Businessfront’s oldest publication, remains the company’s primary revenue driver, but it cannot carry the weight of all the other publications without external capital injection.

Such a capital injection would be crucial for strengthening and sustaining editorial operations, while Businessfront focuses on building a commercial engine — anchored by advertising, sponsorships, and events — for each of its verticals. Without this balance between editorial investment and revenue generation, scaling becomes incredibly difficult in today’s volatile digital media environment.

Ultimately, Businessfront’s situation reflects a broader truth about Africa’s digital media landscape: building and sustaining ambitious, high-quality media operations requires more than creativity and strategy; it requires capital. Without dedicated investment funds or financial instruments to support growth, even the most visionary media companies will struggle to scale to their full potential.

The other side of ANKA’s acquisition

Earlier this week, Ivorian fashion e-commerce startup ANKA announced that New York-based Global Shop Group had acquired it for an undisclosed amount.

Founded in 2016, ANKA evolved from Afrikrea, an online fashion apparel marketplace, into a full-stack infrastructure provider offering logistics, payment solutions, and access to a global audience across over 170 markets. The startup plays a vital role in connecting African creators with international customers, especially in the fashion industry. It has processed more than $60 million in transactions.

African fashion has long been hailed as the next frontier for global exports. But for all the colour and creativity, the numbers still tell a lopsided story. In 2023, the continent’s textile and apparel exports were valued at around $15.5 billion, while imports nearly doubled that at $23.1 billion. The imbalance speaks to a deeper issue: breaking into global retail requires not just great design but also distribution networks, retailer relationships, and capital that African startups rarely command on their own.

For ANKA’s co-founder, Moulaye Tabouré, the acquisition was a necessary step. Despite raising over $13 million and building solid tech, he admits they “needed to go beyond technology” to truly scale their sellers’ businesses, and Global Shop offers “exactly what was missing” to achieve that.

Matilda Ceesay, CEO of Global Shop, says the company plans to make ANKA “stronger and more supportive than ever” to help African sellers attract more customers, streamline operations, and showcase their work to the world.

ANKA’s acquisition offers African creators greater reach through Global Shop’s network. But it also raises a familiar tension: greater visibility versus local control. With foreign capital and infrastructure now steering more of Africa’s fashion pipeline, the continent gains reach but risks losing ownership.

This pattern extends beyond fashion. Across Africa’s creative industries —from music streaming to film distribution and digital art platforms —distribution and scale often come at the cost of ceding control.

Crunch Time 📈

Where Africa’s game developers are building

Curiosity Cabinet 🗄️

Nigeria’s campus journalism associations are quietly shaping the country’s media class. Once seen as student hobbies, these groups have become pipelines feeding some of the biggest newsrooms in and outside Nigeria.

In this week’s edition of Offscript, Guinean-American media entrepreneur Abdulai Jalloh talks about building Bordernation, a pan-African storytelling company, straight out of high school.

The story of one of the only 4 Nigerians who hold the certification to teach an industry-standard animation software.

Rwanda’s film industry is currently having a historic moment. Access to domestic funding is on the rise for Rwandan filmmakers, and the sector is getting busier.

The online gaming value chain in Africa is maturing fast. Russell Southwood, in this two-part series (Part 1 & Part 2), traces its growth and barriers to further development.

Here are the events happening across Africa’s creative economy this weekend and next week:

October 22 -25: The Africa Travel Content Creator Conference (AFTCOC) holds in Kampala, Uganda.

October 23 - 26: Design Week South Africa 2025 holds in Cape Town, South Africa

October 29 - 31: Pan-African film tour, the Annual Film Mischief, takes the third leg of its tour to Tanzania

October 29 — November 2: Lagos Fashion Week holds in Lagos, Nigeria

October 30 – November 3, 2025: Accra Cultural Week holds in Accra, Ghana

October 25 --- January 23, 2026: Lagos Photo Festival holds in Lagos, Nigeria

Over 500 business leaders and investors are gathering at the Counder Conference 2026 to discuss how to support the next generation of cultural and creative entrepreneurs.

Explore more of Africa’s creative economy in one place. Communiqué’s African Creative Economy Database tracks 1,000+ companies, events, investors, and government actors across the continent.

Thank you for reading Communiqué! Please help us give Africa’s media and creative industries the coverage they deserve by donating here.

That’s it for this week’s Digest. See you next week.

Hey, great read as always, it’s really insightful how you connect the dots on these business moves. It makes you think, what if this wave of 'strategic focus' layoffs, even when limited, is a sign that companies are now much quicker to pivot and optimize resources, maybe even with more data-driven insights from AI influencing those decisions in the future?